16 December 2021 may, or may not, become the day from which the allocation of professional firm profits fundamentally changed.

On that day, the Australian Taxation Office (ATO) released Practical Compliance Guidelines PCG 2021/4 (PCG) on the ATO’s compliance approach to the allocation of profits or income from professional firms in the assessable income of the individual professional practitioner (IPP).

The PCG replaces the Assessing the risk: allocation of profits within professional firms’ guidelines (Suspended Guidelines) that the ATO suspended on 14 December 2017.

The PCG had been released in draft on 1 March 2021 as Draft Practical Compliance Guidelines PCG 2021/D2 (Draft) that we wrote about here. There were many criticisms of the Draft. Some of those criticisms are included in the compendium that accompanied the PCG. Most of those criticisms will apply to the PCG.

What does the PCG say?

As we wrote in our earlier article, the PCG (and Draft) is a fundamental change from the Suspended Guidelines. However, apart from the date of effect and transitional rules, differences between the PCG and the Draft are minimal. That is:

1. the PCG does not replace, alter, or affect the operation of the law in any way or create a safe harbour, instead the PCG sets out the ATO’s compliance approach to the allocation of profits or income from professional firms;

2. to apply the ‘risk assessment framework’ (below) the IPP must satisfy two ‘Gateways’:

a. Gateway 1: there must be a sound commercial rationale for entering into and operating the arrangement or structure; and

b. Gateway 2: the arrangement much not exhibit certain high-risk features;

3. where an IPP's circumstances pass the Gateways, the IPP can apply the risk assessment framework to receive a ‘traffic light’ risk assessment rating of green (low risk), amber (moderate risk), or red (high risk). If the IPP does not satisfy the Gateways, the risk assessment framework is not available to the IPP (in these circumstances the PCG says to contact the ATO at ProfessionalPdts@ato.gov.au).

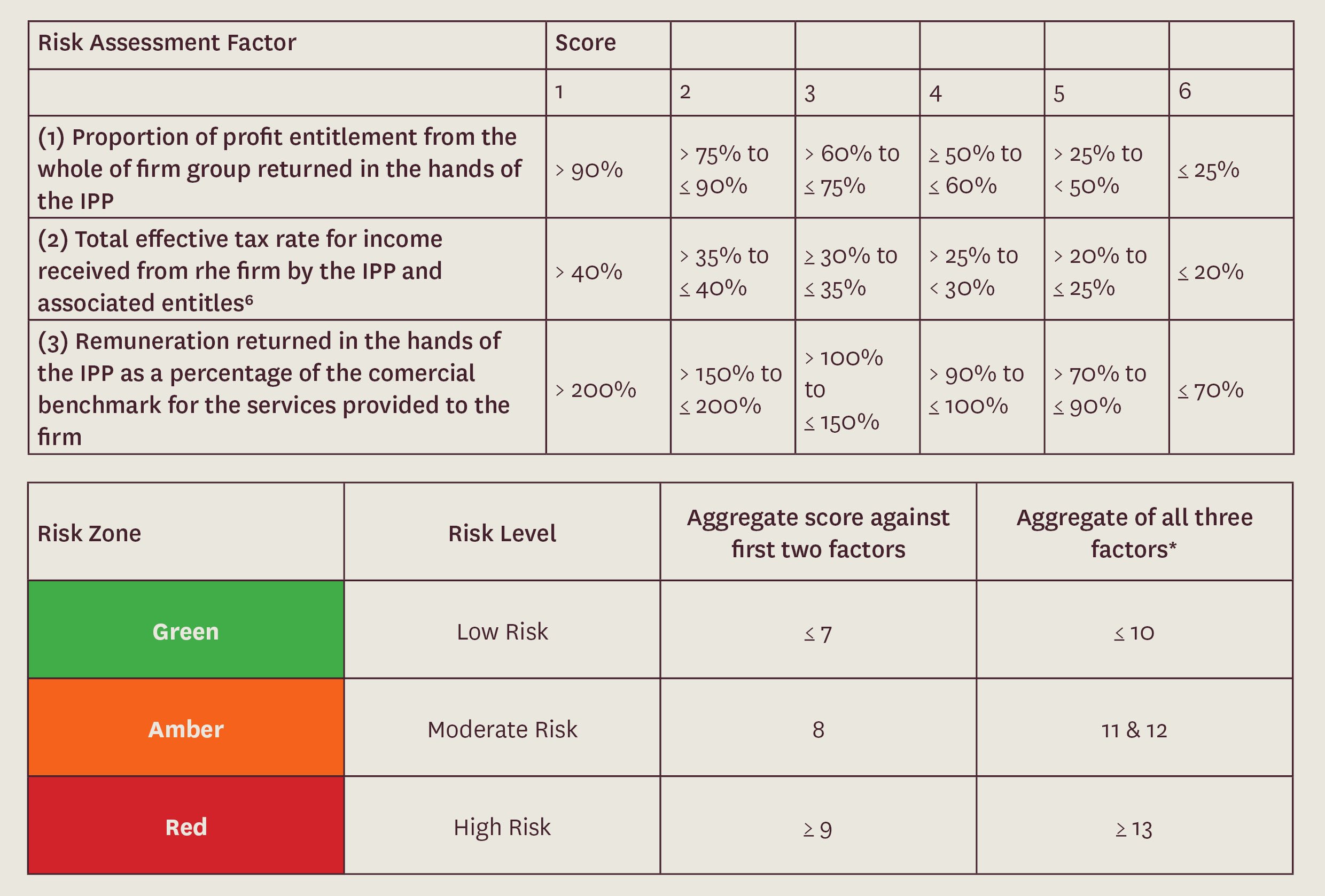

The risk assessment framework in the PCG is largely unchanged from the Draft. That is, the PCG requires an IPP that passes the two Gateways to self-assess against two or three ‘risk assessment factors’. The third risk assessment factor is optional, to determine what ‘risk zone’ the IPP is in. The tables below summarise the risk assessment framework.

What are the differences between the PCG and the Draft?

While the Draft and the PCG take the same approach, there are some differences:

1. the PCG includes five extra examples;

2. an IPP who personally derives at least 50% and has an effective tax rate of 30% (including associates) can now receive a low (green) risk rating;

3. the PCG clarifies that when applying the risk assessment framework to include superannuation, fringe benefits, and other non-cash benefits;

4. the application date, subject to transitional rules (below), of the PCG is 1 July 2022 (1 July 2021 in the Draft); and

5. the PCG includes changed transitional arrangements (below).

The transitional arrangements are more concessional than in the Draft:

1. Taxpayers with pre-existing arrangements can rely on the Suspended Guidelines for the 2018 to 2022 income years provided:

a. the arrangement complies with the Suspended Guidelines;

b. is commercially driven; and

c. does not exhibit high-risk features set out in the PCG.

(The Draft said that only taxpayers who entered into arrangements before 14 December 2017 could rely on the Suspended Guidelines.)

The effect of the above transitional rule is that (broadly) if a pre-existing arrangement satisfies the two Gateways in the PCG it can rely on the Suspended Guidelines. Alternatively, a pre-existing arrangement that does not satisfy the two Gateways cannot rely on the Suspended Guidelines.

Our earlier article summarises the Suspended Guidelines.

2. IPPs with arrangements considered low risk under the Suspended Guidelines can continue to apply those Guidelines to their arrangements until 30 June 2024 (30 June 2023 in the Draft).

This is in recognition of the ‘autumn leaves’ effect. That is, certain arrangements considered low risk (green) under the Suspended Guidelines may have a higher risk rating (amber or red) under the PCG. The transitional period allows those IPPs to continue to apply the Suspended Guidelines to their arrangements until 30 June 2024.

The ATO says that the PCG does not replace, alter, or affect the operation of the law in any way. That is true. However, if the PCG causes behaviour to change because many IPPs do not want to be in the ‘red zone’, or perhaps ‘amber zone’, with increased risk of ATO compliance activity, the effect may be that the PCG becomes the ‘lore’ with respect to the allocation of professional firm profits. Time will tell.

For more information please contact:

Neil Brydges

Principal Lawyer | Accredited Specialist in Tax Law

M +61 407 821 157 | T +61 3 9611 0176

E nbrydges@sladen.com.au

Daniel Smedley

Principal | Accredited Specialist in Tax Law

M +61 411 319 327| T +61 3 9611 0105

E: dsmedley@sladen.com.au

Rob Warnock

Principal Lawyer

M +61 419 892 115 | T +61 3 9611 0155

E: rwarnock@sladen.com.au