In part 8 of our payroll tax series, we explore how payments under an employment agency contract may be subject to payroll tax. The employment agency contracts were initially inserted into the Victorian Payroll Tax Act 2007 (the Act) as an anti-avoidance measure to capture not only traditional employment agency arrangement but also the interposition of entities (“employment agents”) between the service provider and the end client. Similar provisions exist in other States and Territories except for Western Australia. In recent years, particularly in New South Wales, these provisions have been used aggressively by revenue authorities to widen the payroll tax net.

Identifying employment agency arrangements that could be subject to payroll tax

In identifying whether such provisions apply, taxpayers and their advisors must identify:

1. Whether the contract is an employment agency contract?

Section 37 of the Act defines an employment agency contract as a contract, whether formal or informal and whether express or implied, under which a person (an employment agent) procures the services of another person (a service provider) for a client of the employment agent.

For example, a cleaning contractor has a cleaning contract with a hotel. The contractor has its own staff (whose wages are subject to payroll tax) but in busy times it subcontracts to another cleaning business to procure that the subcontractor’s workers provide the cleaning services to the hotel. Here, the contractor must pay payroll tax on payments made to the subcontractor.

Notably this is different from a recruitment agency type arrangement, which is not intended to be subject to payroll tax.

2. Do the employment agent’s workers work in the client’s business?

Given the wide breadth of the employment contractor provisions, the Courts have sought to put some limits on their operation (even though such limits do not exist in the legislation). Examples of narrowing the application of the provisions include the New South Wales Supreme Court’s decisions of UNSW Global Pty Ltd v Chief Commissioner of State Revenue [2016] NSWSC 1852 (UNSW Global) and JP Property Services Pty Ltd v Chief Commissioner of State Revenue [2017] NSWSC 185 (JP Property).

Notably, in UNSW Global it was confirmed that the employment agency provisions should be confined to employment agency contracts that require the service provider would comprise, or who would be added to, the workforce of the client for the conduct of the client’s business.

This approach was also adopted in JP Property, with the NSW Supreme Court finding in that case that the cleaning services were not provided by the cleaners in the conduct of the taxpayer’s business because they were provided outside of business hours, hence falling outside of the payroll tax agency provisions and falling outside of the payroll tax net.

3. If an employment agency contract exists, what payments are deemed to be wages?

If an employment agency contract exists, the type of payments taken to by wages and subject to payroll tax typically include payments from the employment agent to the service provider in connection with the employment agency contract in relation to:

any amount paid in respect of the provision of services;

the value of any benefit provided that would be a fringe benefit;

any payment made that would be a superannuation contribution; and

allowances paid to service providers.

1. If an employment agency contract exists, what payments are not deemed to be wages?

Types of payments that are not deemed to be wages (and therefore not subject to payroll tax) in connection with an employment agency contract include:

Reimbursement of business expenses by the employment agent to the service provider;

GST payable on the supply to which wages paid or payable relates;

Certain types of allowances such as accommodation allowance, motor vehicle allowances and living away from home allowances.

What happens when a contractor is caught by both the contractor provisions and the employment agency provisions?

If a contractor is caught by both the contractor provisions and employment agency provisions, the contractor would be deemed by the legislation to only fall within the employment agency provisions and not under the contractor provisions. While this is welcome in the sense that double payroll tax is not triggered it also means that none of the contractor exclusions may apply to payments to such a contractor/employment agent.

Exemptions that can apply to deemed wages under the employment agency provisions

The contractor exemptions (as discussed in Part 7 of our payroll tax series) do not apply for employment agency provisions. As such, the employment agency provisions have a wider application of the contractor provisions (notwithstanding that the provisions were intended to be anti avoidance in nature).

The general exemptions from payroll tax (for certain charities and not for profit organisations), which we explore further in Part 9 of our payroll tax series, can also apply to payments caught under the payroll tax employment agency provisions. However, the application of those exemptions is not automatic. Rather, employment agents must obtain a written declaration from their charity/not for profit client should they wish to claim an exemption from payroll tax under part 4 of the Act.

Potential issues where a chain of employment agencies exist

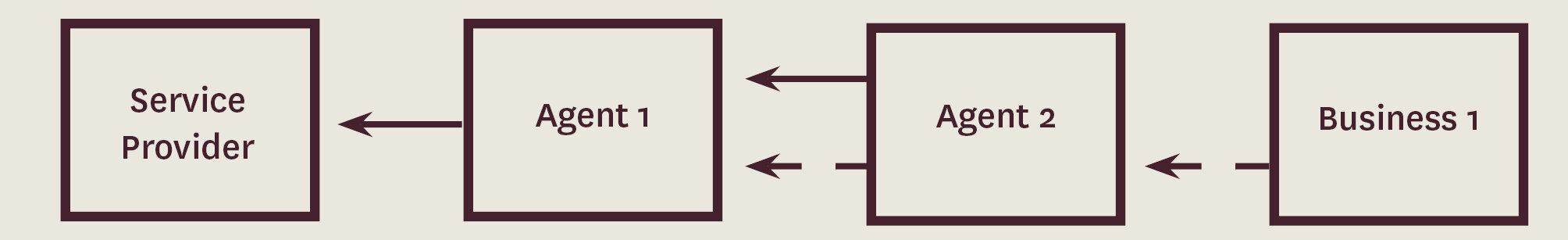

Where a chain of multiple employment agency contracts arise (e.g. agent 1 on-hires labour to agent 2, which further on-hires that labour to the client – see the diagram below) each employment agent is liable for payroll tax on its respective payments even though they effectively represent one contracting arrangement. To deal with this issue, the Victorian Commissioner of State Revenue has published in Revenue Ruling PTA027 (Ruling) that states that only the employment agent closest to the ultimate client (eg agent 2 in our diagram below) will be required to pay payroll tax on the payment for the workers in question.

However, taxpayers must be aware that two 2019 decisions in the Supreme Court of New South Wales appear to be at odds with the Ruling (which is standardised across all relevant jurisdictions in Australia).

In Southern Cross Group Services Pty Ltd v Chief Commissioner of State Revenue [2019] NSWSC 666 and Securecorp (NSW) Pty Ltd v Chief Commissioner of State Revenue [2019] NSWSC 744, the Court rejected the submission that only the employment agent closest to the end user of the services is liable for payroll tax. The Court held that the Act itself makes no reference to the end user of the services and ‘end user’ is an inherently ambiguous term. In light of the strict interpretation of the statute the payroll tax employment agency provisions do expressly contemplate the possibility of double taxation. Therefore, despite the public position contained in Ruling, the provisions cannot be interpreted to contain the imposition of payroll tax to the employment agency contract closest to the ultimate end user.

Application of anti-avoidance provisions

Taxpayers must also consider the application of the anti-avoidance provisions contained within section 42 of the Act. If the effect of an employment agency contract is to avoid or reduce payroll tax liability, the Commissioner may disregard the contract or determine that any party to the contract is deemed to be an employer for payroll tax purposes.

If you have any further questions on payroll tax or state taxes, please contact one of the members of our specialist team:

Denise Tan

Senior Associate

M +61 438 714 965 | T +61 3 9611 0160

E: dtan@sladen.com.au

Phil Broderick

Principal

M +61 419 512 801 | T +61 3 9611 0163

E: pbroderick@sladen.com.au

Laura Spencer

Senior Associate

M +61 436 436 718 | T +61 3 9611 0110

E lspencer@sladen.com.au

Lucy Liang

Graduate Lawyer

E lliang@sladen.com.au