Draft Tax Determination highlights the risks of back-to-back CGT Roll-overs.

We have previously written on the ATO publishing guidance on demergers and back-to-back CGT roll-overs. As anticipated, Draft Taxation Determination TD 2019/D1 has been released which, although concerning demergers, may be illustrative of the ATO’s views more broadly in the context of back-to-back CGT roll-overs.

Taxpayers often contemplate using multiple CGT roll-overs to restructure their businesses tax-effectively (subject to the operation of the general anti-avoidance provisions).

TD 2019/D1 discusses what is a ‘restructuring’ for the purposes of the demerger provisions. What is a ‘restructuring’ is a key concept in the context of demergers as that determines what is in the demerger group (and thus what can be demerged) and links with the requirement that the shareholders in the demerger group receive shares in the demerged entity and ‘nothing else’.

For example, if there is a demerger followed by a scrip-for-scrip roll-over does the restructuring only include the first transaction or both transactions? In a multi-step transaction, there has been concern that the selling entity may receive both (say) a share and a right to receive consideration under the second roll-over.

The ATO in TD 2019/D1 adopts a strict approach as to what transactions form part of the ‘restructuring’. The view is that a series of distinct steps and transactions, even if those transactions are legally independent, can form a single arrangement, plan, or reorganisation. Including or excluding steps in the restructuring may cause the demerger to not satisfy the ‘nothing else’ requirement in the demerger provisions.

While TD 2019/D1 concerns demergers, other CGT roll-overs include a ‘nothing else’ requirement and others have a requirement that the seller must only receive a specific form of consideration.

The result of the ATO views on what is a ‘restructuring’ is that taxpayers may be ineligible from obtaining CGT roll-over relief, not just for demergers, but also from other common transactions.

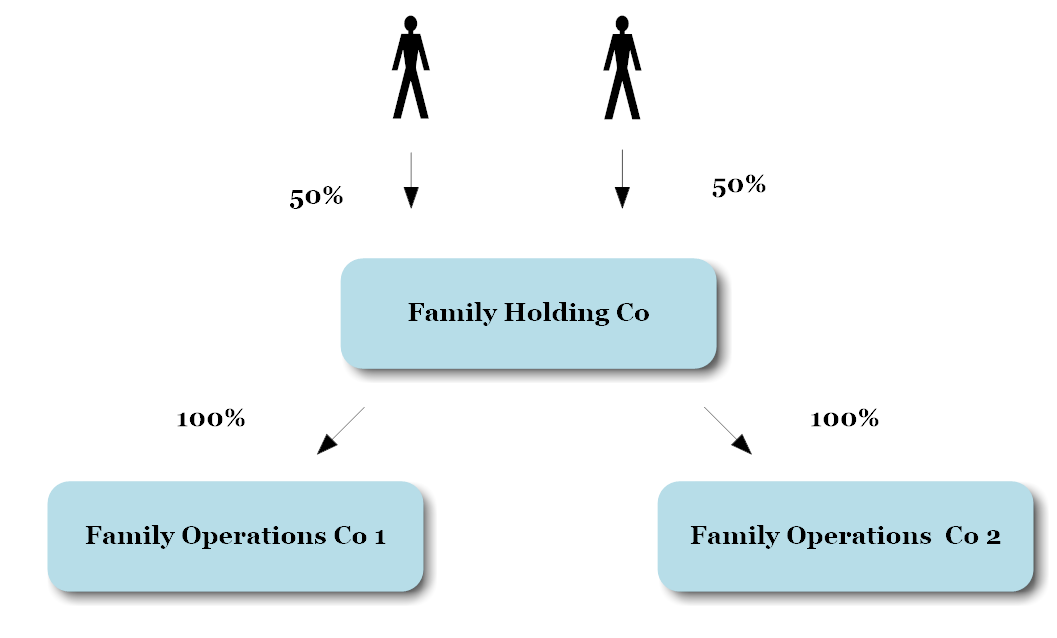

This point is highlighted in example 6 of TD 2019/D1, which concerns two brothers who own a company equally and, due to a falling out, wish to separate the operations and ownership of the business. The steps are reflected diagrammatically here:

Current Structure:

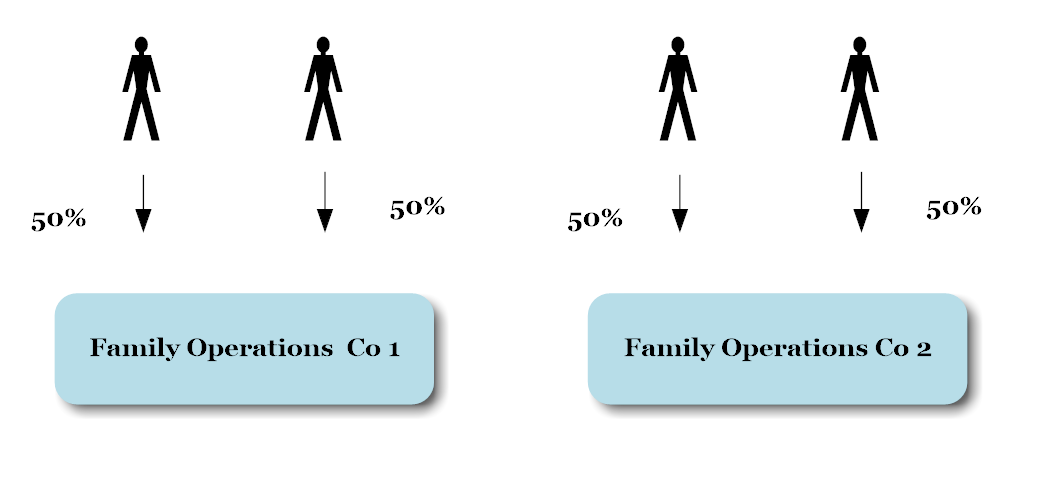

Step 1 – Demerger so that Brother 1 and Brother 2 own equal shares directly in Family Operations Co 1 and Family Operations Co 2.

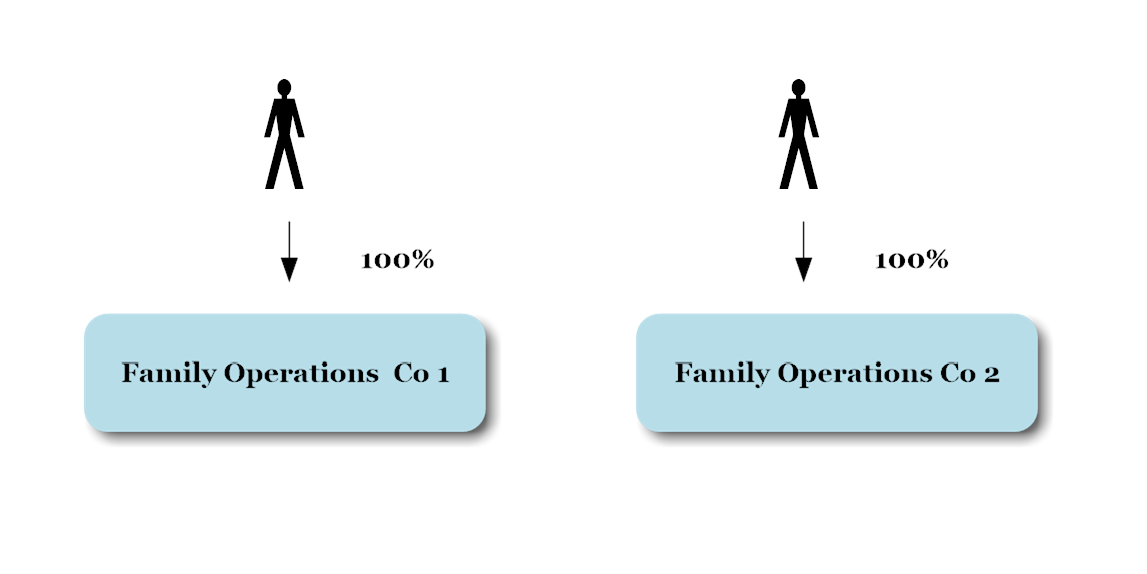

Step 2 – Further reorganisation so that Brother 1 owns 100% of Family Operations Co 1, and Brother 2 owns 100% of Family Operations Co 2.

In the ATO’s view, step 2 forms part of the overarching plan of the business reorganisation, thereby falling within the concept of a ‘restructuring’ and resulting in the brothers losing their entitlement to CGT demerger roll-over relief under step 1.

The ATO’s draft views, as expressed in TD 2019/D1, highlight the risks associated with successive or back-to-back CGT roll-overs, and the need to obtain appropriate professional advice before implementing the transaction.

Accordingly, taxpayers wishing to undertake a business restructure (and particularly a demerger) should carefully consider their arrangement to ensure that other steps, actions, or transactions are not grouped together.

For more information please contact:

Edward Hennebry

Associate

T +61 3 9611 0113

E: ehennebry@sladen.com.au

Neil Brydges

Principal Lawyer | Accredited Specialist in Tax Law

M +61 407 821 157 | T +61 3 9611 0176

E: nbrydges@sladen.com.au

Daniel Smedley

Principal | Accredited Specialist in Tax Law

M +61 411 319 327| T +61 3 9611 0105

E: dsmedley@sladen.com.au