Super Guarantee Series - Part 1: An Overview of the Super Guarantee System

Super Guarantee Series

The superannuation guarantee (Super Guarantee) system is the Federal Government system under which employers make superannuation contributions on behalf of their employees, certain contractors and other persons. The Super Guarantee system is complex and the obligation to pay Super Guarantee is often not straightforward: involving a factual-based analysis of contracts and individual employee circumstances.

The ATO’s administration and enforcement of the Super Guarantee regime have seen significant development over recent years. In 2018 the Federal Government offered an amnesty to employers to disclose and pay previously unpaid Super Guarantee charges for the quarters between 1 July 1992 and 31 March 2018 without incurring the administration component charge or Part 7 penalties. In addition, payments of Super Guarantee charge made to the ATO under the amnesty were tax deductible. Following the end of the Super Guarantee amnesty on 7 September 2020, the ATO applied a strict compliance approach to the enforcement of Super Guarantee obligations (PSLA 2020/D1).

Timing is essential and the consequences for failing to pay Super Guarantee are serious – penalties can be imposed at a rate equal to double the Super Guarantee charge payable by the employer for the quarter (200% of the Super Guarantee charge).

In light of the increased regulatory scrutiny after the introduction of Single Touch Payroll, it is crucial that employers are aware of their obligations to pay Super Guarantee. In this Super Guarantee Article Series, our Superannuation Team uses their expertise to help clients navigate the complex and ever-evolving superannuation space.

This Series will cover the following topics:

Part 1: An Overview of the Super Guarantee System

Part 2: The Definition of Employee

Part 3: Applying Super Guarantee to Contractors

Part 4: Super Guarantee Charges

Part 5: What to Do with Late Contributions

Part 6: Penalties and Remissions in the Post Amnesty Era

Part 7: The Application of the Director Penalty Regime to Super Guarantee

What Is Super Guarantee?

The Super Guarantee regime is established under the Superannuation Guarantee (Administration) Act 1992 (SG Act). The Super Guarantee regime broadly requires employers to make super contributions for their employees equal to at least the minimum level of superannuation support set out in the legislation. For the 2022 financial year, that minimum level is 10.5% of an employee’s ordinary time earnings. The question of which employees must be paid Super Guarantee contributions will be discussed in part 2 of this Series.

A common misconception is that it is compulsory under the law for employers to make superannuation contributions on behalf of their employees. This is not technically correct. Due to the limitations of the Commonwealth heads of power under the Constitution, the Super Guarantee regime has been legislated as a tax. That is, if an employer fails to make Super Guarantee contributions on behalf of its employees in the required amount by the deadline for the relevant quarter, it does not ‘contravene’ the super regime. Instead, a tax liability arises as calculated under the SG Act, known as the Super Guarantee charge. Super Guarantee charge is not tax deductible to the employer.

Further, where Super Guarantee is underpaid or paid late, the employer also has an obligation to lodge a Super Guarantee charge statement. Where the Super Guarantee charge statements are not lodged, further penalties are automatically applied under Part 7 of the SG Act (Part 7 penalties). While these penalties are applied automatically under the SG Act, the Commissioner of Taxation typically has the discretion to remit Part 7 penalties in whole or part.

Contribution Quarters

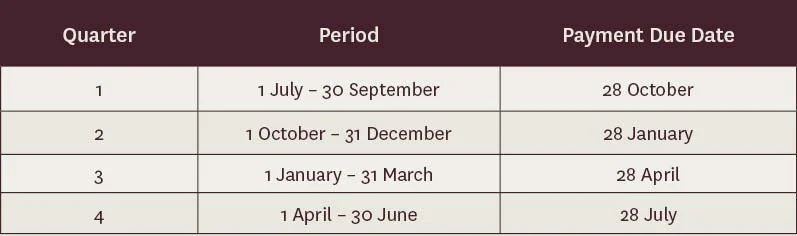

To avoid late payments and therefore to trigger the Super Guarantee charge, Super Guarantee contributions must be made quarterly, within 28 days after the end of the relevant quarter, as shown in the table below:

Employers and employees can contractually agree to make super contributions more frequently than quarterly, for example, fortnightly or monthly. If they do, the employer must ensure the total Super Guarantee contribution for each quarter is made by the due date.

* * * * *

If you have any questions about how super guarantee should apply in your circumstance, please contact our specialist team at:

Phil Broderick

Principal

M +61 419 512 801 | T +61 3 9611 0163

E: pbroderick@sladen.com.au

Philippa Briglia

Senior Associate

T +61 3 9611 0173

E pbriglia@sladen.com.au

Jan Oh

Graduate Lawyer

T +61 3 9611 0158

E joh@sladen.com.au