As previously discussed here, the May 2021 budget announcements included a number of changes aimed at increasing flexibility in the superannuation system. Some of these key changes have now been introduced to Parliament as part of the Treasury Laws Amendment (Enhancing Superannuation Outcomes For Australians and Helping Australian Businesses Invest) Bill 2021 (Bill).

The main changes in the Bill are:

Removal of minimum $450 threshold for superannuation guarantee (SG) purposes;

Increase in release amount under First Home Super Saver Scheme (FHSSS) from $30,000 to $50,000;

Reduction of eligibility age for downsizer contributions from age 65 to age 60;

Removal of work test for individuals aged between 67 and 75 to make salary sacrifice and non-concessional contributions (but not personal deductible contributions);

Access to bring forward rule for non-concessional contributions (NCC) now available up to age 75;

Ability for super trustees to choose their preferred method of calculating exempt current pension income (ECPI) where the fund’s assets are held solely to discharge pension liabilities for part of an income year.

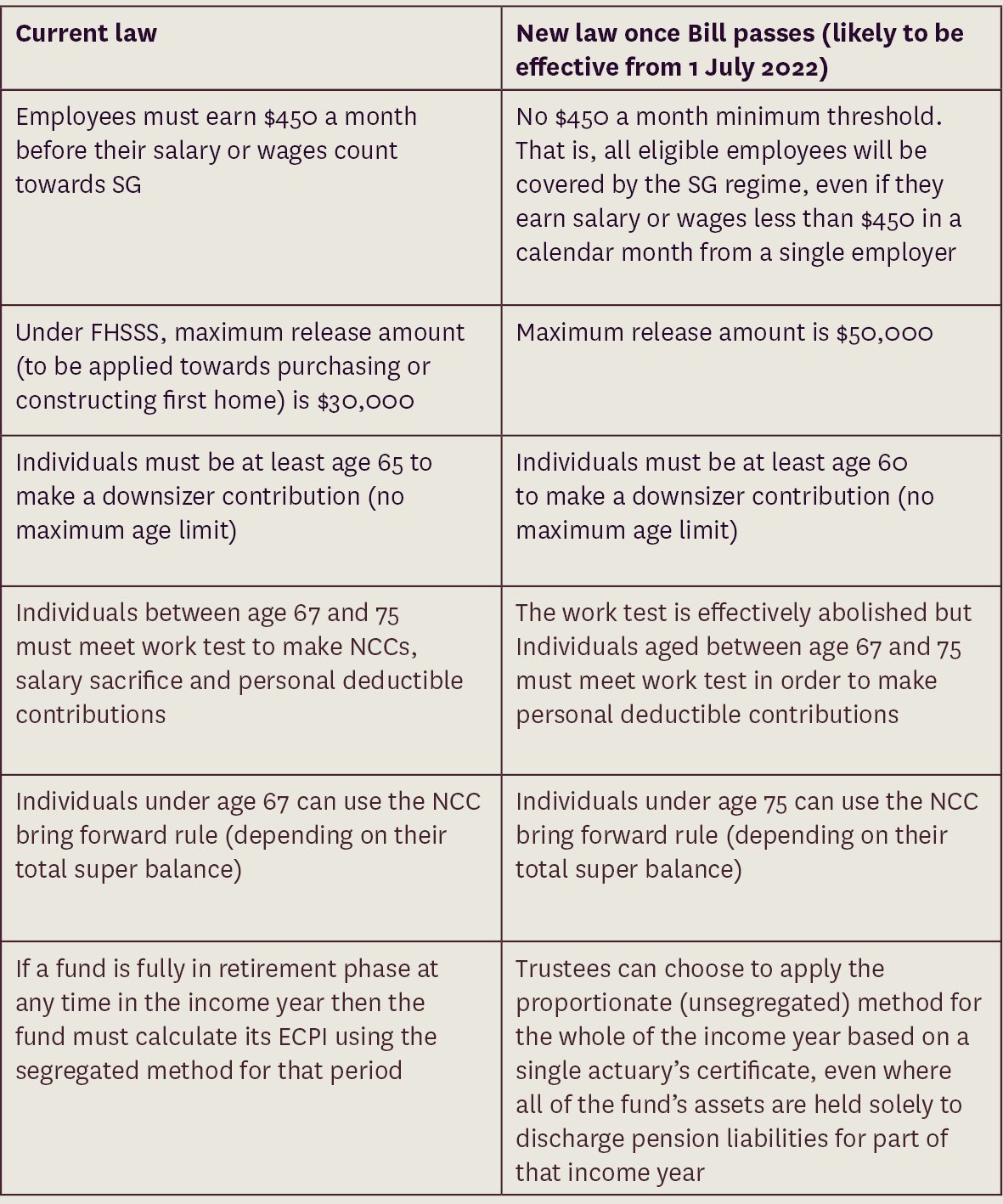

The table below shows the current law, compared with the changes contained in the Bill:

Phil Broderick

Principal

M +61 419 512 801 | T +61 3 9611 0163

E: pbroderick@sladen.com.au

Philippa Briglia

Senior Associate

T +61 3 9611 0173

E pbriglia@sladen.com.au