Part 1 International tax series: are you a resident or non-resident?

This is the first article in a series relating to the Australian tax consequences for resident and non-resident beneficiaries of Australian and foreign trusts.

In this first article we explore the Australian tax residency rules.

The tax consequences for beneficiaries of Australian trusts differ depending on whether the beneficiary is an Australian resident or a non-resident. There are also differing consequences depending on whether the beneficiary is an individual, trust, or company.

The residency of a beneficiary should be considered before making distributions of income, capital gains, dividends, or capital.

Source and residency

Before exploring the residency tests, the fundamental principle is that an Australian tax resident is assessed in Australia on ordinary and statutory income from all sources whether inside or outside of Australia unless a statutory rule overrides this general rule. A non-resident is generally assessable only on income from Australian sources or on income on a basis other than having an Australian source.

Australia’s double tax treaties, for countries where Australia has such an agreement, can alter these general principles.

The “source rules” help Australia tax income derived by non-residents while the “residency rules” cause the taxation of Australian tax residents on their worldwide income.

For instance, if income derived by an Australian resident trust has an Australian source and the trust distributes that income to a foreign beneficiary, prima facie Australia has a right to tax that distribution. Conversely, foreign source income derived by an Australian trust may not be subject to Australian tax if distributed to a foreign beneficiary but should be if distributed to an Australian beneficiary.

That is while different concepts, source and residency are “two sides of the same coin” when it comes to determining any Australian tax liability on a distribution to a beneficiary.

Determining the tax residency of beneficiary, whether it is an individual, company, or trust, is the first step in determining the tax implications from income distributed to that beneficiary. The rules are complex and often require analysis on a case-by-case basis.

Individual residence

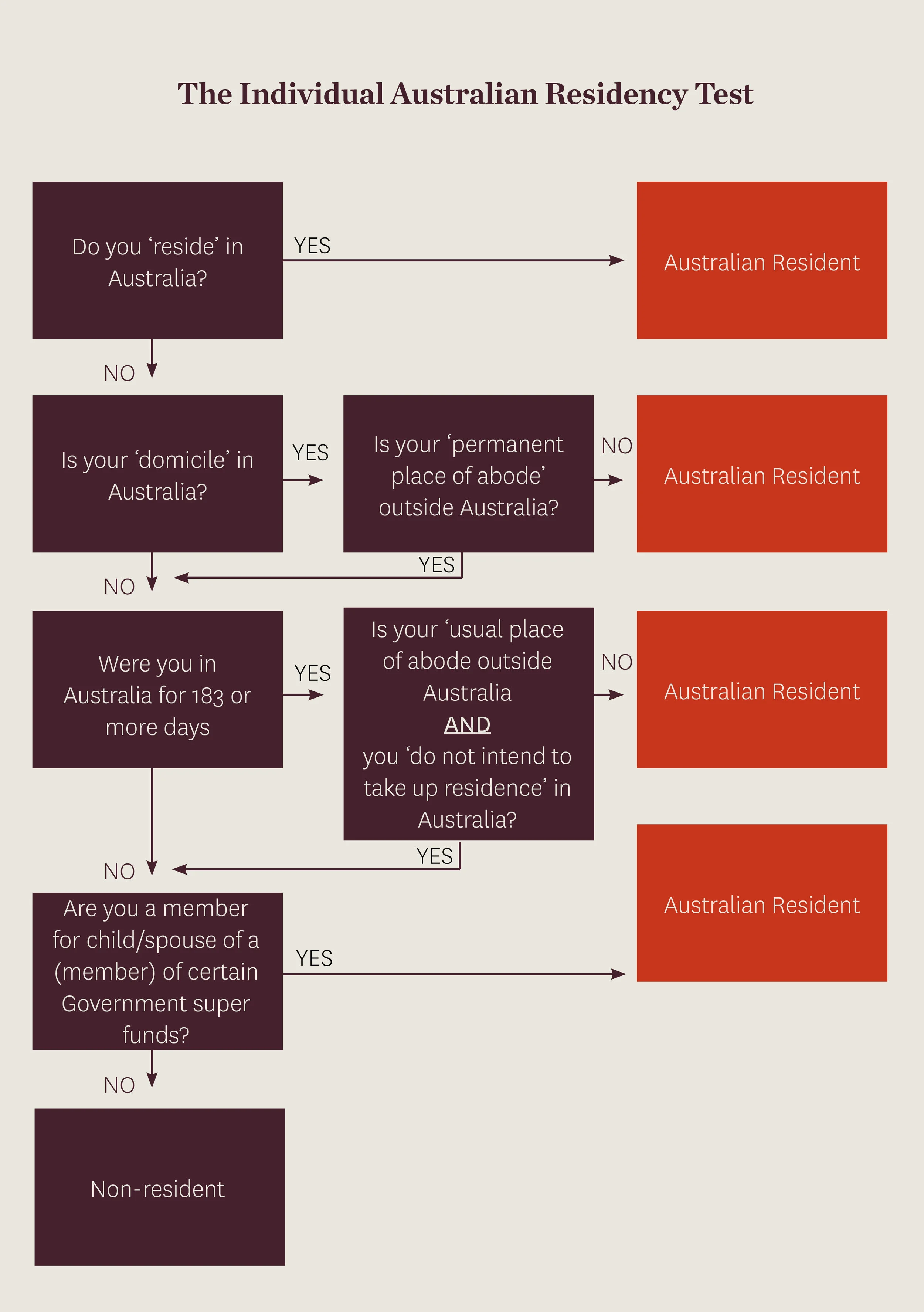

An individual is an Australian tax resident if he or she satisfies any one of the following four tests:

the ordinary residence test: the individual is a resident of Australia according to ordinary concepts (which is different to the concepts of domicile, nationality, and citizenship);

the domicile test: the individual has an Australian domicile unless the individual has a permanent place of abode outside Australia;

the 183-day test: the individual has been in Australia, continuously or intermittently, for at least 183 days in the year of income unless the individual’s permanent place of abode is outside Australia and the individual did not intend to take up Australian residence; or

the Commonwealth superannuation test: the individual is a member of certain Commonwealth government superannuation schemes (or the spouse, or child under 16, of such a person).

Apart from the Commonwealth Superannuation test, the other tests require a factorial analysis. The factors are not set in stone with no one factor in isolation determining residency. As such, the tax residency of an individual requires a case-by-case analysis with all the factors examined in context. This context can include circumstances before and after the time of determining residency (or non-residency). Factors include:

the person’s intentions and purposes in Australia and outside of Australia;

the extent of the person’s family, business, or employment ties with Australia and outside of Australia;

the maintenance and location of the person’s assets and investments; and

the person’s social and living arrangements.

An individual can be tax resident of more than one country. For countries where Australia has a double tax agreement, the agreement will have a ‘tie breaker’ rule in these circumstances.

The individual residency test is summarised below (application of double tax agreements excluded).

For more information regarding Australia’s individual tax residency rules, refer to our previous report.

Companies

A company is a resident of Australia if:

incorporated in Australia; or

if not incorporated in Australia, the company carries on business in Australia and:

its central management and control (CMC) are in Australia; or

shareholders who are Australian tax residents control the voting power of the company.

The High Court in 2016 considered the CMC aspects of the corporate residency test in the case of Bywater Investments Ltd & Ors v FCT; Hua Wang Bank Berhad v FCT (Bywater).

Following the Bywater decision, the Australian Taxation Office (ATO) issued Taxation Ruling TR 2018/5 and Practical Compliance Guideline PCG 2018/9 with its views on where the exercise of the CMC of a company occurs.

TR 2018/5 states as “a starting point” the ATO considers that the directors of a company exercise CMC. However, where facts suggest otherwise, the ATO will consider other factors including:

where the governing body of the company, the board of directors, meets;

where the company declares and pays dividends;

the nature of the company’s business and whether it dictates where CMC decisions are made in practice; and

where minutes or other documents record the making of the high-level decisions of the company.

In relation to the exercise of CMC by the directors, the ATO looks at where the real decision making occurs and not merely the implementation or “rubber stamping” of decisions made by “dummy directors” (something that occurred in Bywater).

Controversially, the ATO considers in TR 2018/5 that where a company carries on business and has its CMC in Australia, the company carries on business in Australia within the meaning of the CMC test of residency. That is, the ATO considers that it is not necessary for any part of the actual trading or investment operations of the business of the company to take place in Australia – CMC is enough.

For more information regarding corporate tax residency, refer to our previous report.

Trusts

A trust is an Australian tax resident for an income year if a trustee was an Australian resident at any time during the income year or the CMC of the trust was in Australia at any time during the income year.

The tests are interactive. For example, a trust with a foreign company as trustee will be an Australian resident trust if the foreign company carries on business in Australia and the company’s CMC is in Australia causing the trustee to be an Australian resident. Similarly, if there is a foreign resident trustee (individual or corporate), and the trustee exercises the CMC of a trust in Australia, the trust will be an Australian tax resident despite the trustee being a foreign resident.

If a trust is a unit trust, there is a different test for capital gains tax (CGT) purposes, with the basic test for other purposes. A unit trust is an Australian tax resident for CGT purposes for an income year if at any time:

any property (not just real property) of the trust is situated in Australia or the trust carries on a business in Australia; and

the CMC of the unit trust is in Australia or one or more Australian residents held more than 50% of the beneficial interests in the income or property of the trust.

Therefore, it is possible for a unit trust to be a non-resident for most Australian tax purposes but a resident trust for CGT purposes (or vice versa). For example, a unit trust may have a foreign trustee and CMC (and so would not be an Australian tax resident for most purposes) but if the unit trust owned property situated in Australia and Australian residents held more than 50% of the units, the trust could be an Australian resident trust for CGT purposes.

Double tax agreements

Double tax agreements (DTAs) reduce or eliminate double taxation caused by overlapping tax jurisdictions and allocate taxing rights between the countries over different categories of income. DTAs also include rules to resolve dual claims in relation to the residency status of a taxpayer and the source of income. Australia has DTAs with more than 40 countries.

For more information regarding the application of DTAs to individuals, please refer to our previous report.

State taxes

The concept of foreign persons, companies, or trusts for State or Territory taxes differs from the federal income tax concepts (above) and between each state and territory. Foreign persons and entities can be liable for surcharges on land transfer duty and land tax and the land tax (absentee owner) surcharge.

Sladen Legal’s State taxes team has written about the State and Territory tests here.

This is the first in our international tax series. In our next article, having determined that a beneficiary or trustee is a non-resident, we discuss the income tax issues.

To discuss or for further information please contact:

Neil Brydges

Principal Lawyerl | Accredited Specialist in Tax Law

M +61 407 821 157 | T +61 3 9611 0176

E: nbrydges@sladen.com.au

Patricia Martins

Associate

T +61 3 9611 0138

E: pmartins@sladen.com.au

Kelvin Yuen

Lawyer

T +61 3 9611 0177

E: kyuen@sladen.com.au