Landholder duty is a regime that was introduced to impose duty on acquisitions in landholding entities. These complicated provisions are difficult to understand, and yet are increasingly becoming a compliance area of focus for revenue authorities. This is Part 2 of a series of articles by our State Taxes Team on landholder duty that deconstructs the complex provisions by providing a snapshot on landholder duty and its application with regards to private entities.

Introduction

In part 1 of these series of articles, we discussed how to first ascertain if an entity falls within the landholder regime. We continue in part 2 of this article to ascertain how to how to identify the landholdings of a landholder.

Constructive land holding provisions – what land is counted in the landholder regime?

There are deeming provisions contained in duties legislation throughout Australian state and territories that increase the scope of the landholder duty regimes, often to the surprise of unsuspecting taxpayers.

In essence, not only are land holdings directly held by a landholder entity included in the regime, but also land holdings indirectly held through subsidiaries and/or lands held in certain discretionary trusts.

Subsidiaries and linked entities

An entity’s land holdings will also include land indirectly held through subsidiary entities or linked entities.

For example, an acquisition of 100% of the shares in a corporate landholder triggers a landholder duty liability based on the value of all directly or indirectly held land through subsidiaries in a corporate structure.

Please note that the ability to link or look through subsidiaries and linked entities differ in each state and territory and vary generally according to the minimum threshold of land ultimately linked in the chain.

Example – 100% acquisition in a private company

In this example, Company A Pty Ltd would be deemed to have landholdings (both directly and indirectly held through subsidiaries or linked entities) with a market value of $8.5 million. The current estimated Victorian duty to apply on a relevant acquisition of a 100% interest in Company A Pty Ltd would be $467,500.

Discretionary trusts

Each jurisdiction also contains a ‘deeming provision’ which can deem the land of a discretionary trust to be held by the landholder (and/or its subsidiaries/linked entities).

These deeming provisions were inserted into the landholder regime as “anti-avoidance” provisions to ensure taxpayers do not avoid the landholder regimes by the use of discretionary trusts. However, rather than inserting traditional anti-avoidance rules, the legislators have instead inserted rules to automatically deem the land held by discretionary trusts as being held by landholders.

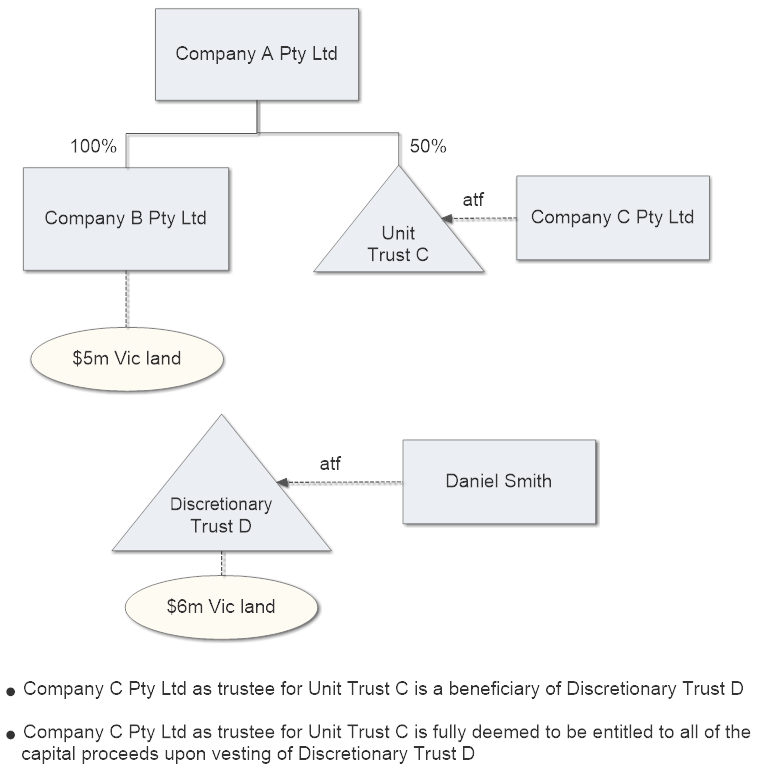

Example - constructive land holding and discretionary trust provision

In this example, Company A Pty Ltd would be deemed to have landholdings (both directly and indirectly through linked entities, including Unit Trust C which is a beneficiary of Discretionary Trust D) with a total market value of $8 million. Based on Victorian duty rates, the estimated duty to apply on a 100% acquisition of Company A Pty Ltd would be $440,000.

As many discretionary trust deeds are drafted broadly to include in the class of beneficiaries corporations in which another beneficiary has an interest (eg a corporate beneficiary), these constructive land holding and discretionary provisions are very broad and have the potential to operate in an unintended way. This is particularly so if the corporate beneficiary in question never has received, and never will receive, any capital distributions.

The different revenue offices acknowledge this to a degree and have provided differing abilities (within the legislation and/or published rulings) that enable the various Commissioners of State Revenue to deem that the corporate beneficiaries are not entitled to the lands of the discretionary trusts.

For a further discussion on how the constructive land holding and discretionary trust provisions operate in each state and territory, please refer to the two-part article titled Discretionary Trusts and landholder duty’ that is contained in the February 2019 and March 2019 editions of the Taxation in Australia Journal published by The Tax Institute.

In parts 3 and 4 of this series, we will discuss the aggregation rules.

If you have any further questions on the application of landholder duty or state taxes, please contact one of the members of our specialist team:

Phil Broderick

Principal

Sladen Legal

T +61 3 9611 0163 l M +61 419 512 801

Level 5, 707 Collins Street, Melbourne, 3008, Victoria, Australia

E: pbroderick@sladen.com.au