Victorian Supreme Court strikes a blow to payroll tax clampdown against the healthcare industry: The Optical Superstore Case

Lately, revenue authorities have focused heavily on investigating medical, dental, optometry and other allied health clinics. This has included investigating their structuring arrangements with to ascertain whether such arrangements include deemed “wages” paid to medical professionals which should be subject to payroll tax.

An arrangement involving optometrists was contested in the recent Victorian Supreme Court decision in The Commissioner of State Revenue v The Optical Superstore [2018] VSC 524. This decision is an important win to taxpayers and draws improved boundaries in the statutory interpretation of the payroll tax provisions.

Summary of the facts

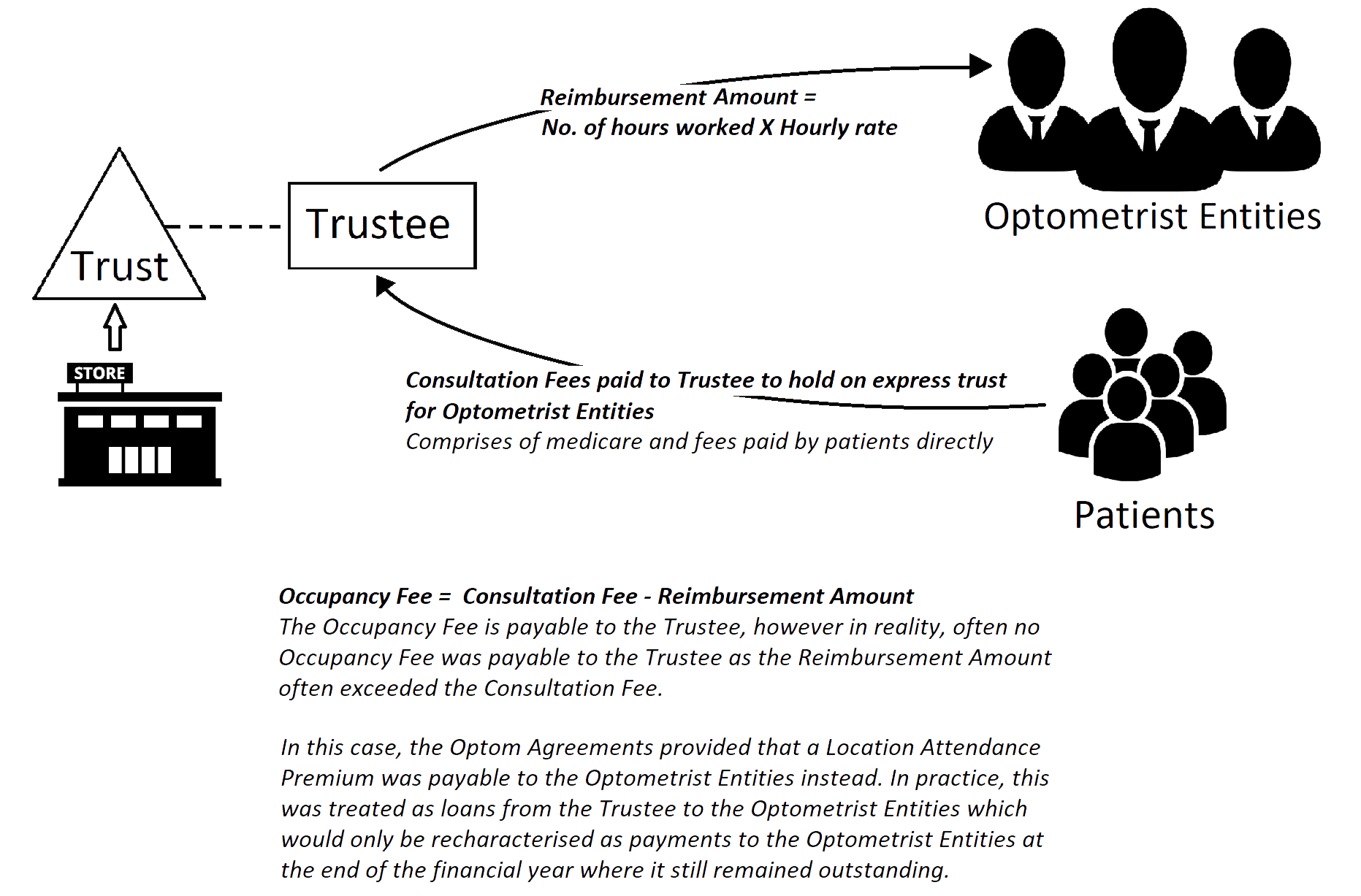

The matter involved the Optical Superstore Pty Ltd, a trustee of four related trusts which together carried on an optical dispensary business known as the ‘Optical Superstore’. There were Optum Agreements entered into with the Optometrist Entities (either directly with optometrists or with their respective companies or trusts) which entailed an arrangement under which the Optometrist Entities would operate in Optical Superstore locations. The arrangement included, in simple terms, the following payments:

In order for payments in this matter to be deemed as wages under the Payroll Tax Act 1971 (Vic) and Payroll Tax Act 2007 (Vic), the money had to be paid or payable by an employer during a financial year for or in relation to the performance of work relating to a relevant contract.

Court findings

Justice Croft concluded that payroll tax is not triggered on amounts derived from providing services to third parties. That is, here, the Optometrist Entities derived the consultation fees (Medicare payments and patient fees) from providing optometrist services to patients of the optometrist stores and, as such, payroll tax was not triggered on those fees. This applied even in an express trust arrangement as the consultation fees derived by the Optometrist Entities, that were directed to be paid to the Trustee to be held on express trust for the Optometrist Entities, were subsequently paid to the Optometrist Entities in the form of “reimbursement amounts”.

Thus, Justice Croft found that the payments from the Trustee (ie the “reimbursement amounts”) were not subject to payroll tax and appeal was dismissed in favour of the taxpayer. In making this finding the following points were made:

The meaning of “payment” does not extend to the return of money by one person to another in circumstances where the second person earned that money from providing services to a third party and directed the money deposited in the bank account of the first person and held in trust

There is “manifestly no intention…to impose payroll tax liability on the passing of money which would not otherwise amount to payment”

The use of the trust structure could not alter the essential character of the payments as the return of monies by way of distributions under an express trust

It was of critical importance that the source of the distribution was the beneficiaries’ (ie the Optometrist Entities’) own funds (ie the consultation fees)

That essential character is incompatible with the distributions being “payments for or in relation to the performance of work”

This is to be distinguished with distributions from discretionary trusts or distributions from trusts to employees

The amounts returned to the Optometrist Entities were not “paid or payable for or in relation to performance of work” in accordance with section 35(1) of the Payroll Tax Act 2007

The above findings were found notwithstanding that:

There was a “degree of artificiality about the arrangements” and the agreements “established rather an odd regime”

The Trustee deducted “occupancy fees” from the consultation fees before paying the “reimbursement amounts”

The “reimbursement amount” paid from the Trustee to the Optometrist Entities was calculated on the number of hours worked in the stores rather than the consultation fees derived

The “reimbursement amount” could sometimes exceed the consultation fees in which case, to the extent the reimbursement amounts exceeded the fees, such amounts were treated as loans from the Trustee to the Optometrist Entities or ultimately as “location attendance premiums” (which were subject to payroll tax)

The customers were the customers of the Trustee (not the Optometrist Entities)

The essential arrangement was to ensure that the Optometrist Entities would ensure attendance of optometrists at the Trustee’s stores at agreed times in order that those optometrists would provide optometry services to customers to the Trustee

The arrangements were put in place to benefit the Trustee because the provision of optometrist services would lead to increased sales of frames, lenses and other optometry products (the profits of which went to the Trustee)

If “payments” had existed in this matter, a broad approach to interpreting the provisions would be taken to find that the payments would be “for or in relation to the performance of work”

An analogy provided in the judgement was that of an arrangement between a barrister and his/her clerk, in which a barrister’s client would make typically payments to the clerk, who would then deduct any agreed clerking fee and disbursements before paying the balance to the barrister. The court observed that this analogy illustrated that the construction contended for by the Commissioner would give the payroll tax provisions an unintended reach.

Implication on taxpayers

The decision is an important case for medical practices and similar allied health clinics, as it confirms that patient income derived by such professionals should not be subject to payroll tax. Therefore, a practice under which the professionals derive the fees personally and pay a service entity a fee for running the practice should not be subject to payroll tax on those patient fees. Whereas, a practice which derives the patient fees itself and pays the professionals a wage would be subject to payroll tax on those wages.

In light of this, former decisions issued by revenue authorities should be reviewed, while past and current taxpayer operating models should be reassessed to ascertain a taxpayer’s correct tax and compliance position.

To discuss this further or for more information please contact:

Phil Broderick

Principal

Sladen Legal

T +61 3 9611 0163 | M +61 419 512 801

Level 5, 707 Collins Street, Melbourne, 3008 Victoria, Australia

E: pbroderick@sladen.com.au

Denise Tan

Senior Associate

Sladen Legal

T +61 3 9611 0160 | M +61 438 714 965

Level 5, 707 Collins Street, Melbourne, 3008 Victoria, Australia

E: dtan@sladen.com.au