Draft Taxation Determination TD 2022/D1 sets out the Australian Taxation Office’s (ATO) views on when an unpaid present entitlement (UPE) with a corporate beneficiary is a loan for the purposes of Division 7A of the Income Tax Assessment Act 1936. We wrote about TD 2022/D1 here.

When the ATO finalises TD 2022/D1 it will apply from 1 July 2022 and the ATO will withdraw Taxation Ruling TR 2010/3 and Practice Statement Law Administration PSLA 2010/4. PSLA 2010/4 included three options to hold an amount representing a UPE on ‘sub-trust’ if the trust had not discharged the UPE or placed it on Division 7A complying terms.

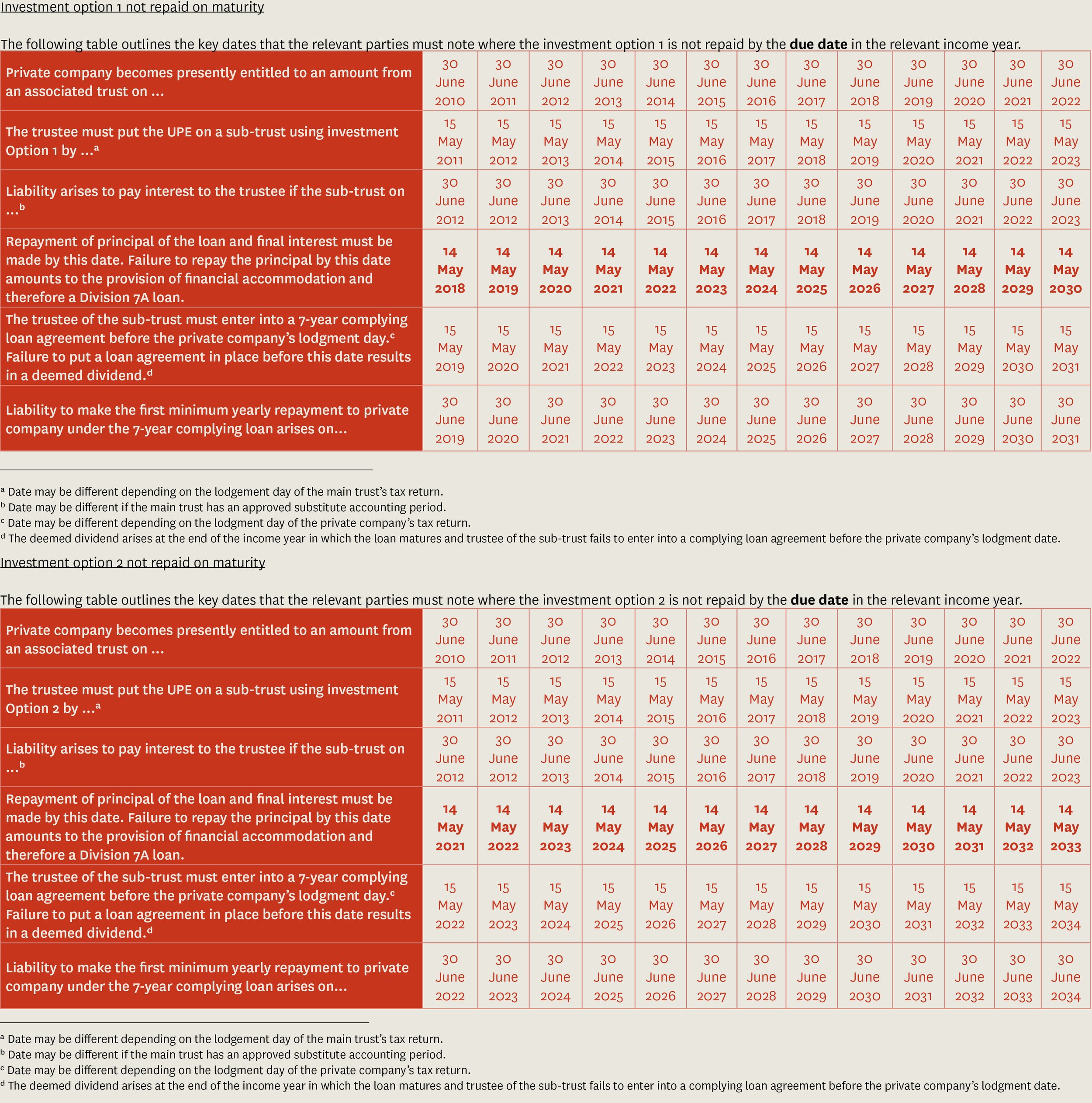

Option 1 is a 7-year interest only arrangement and Option 2 is a 10-year interest only arrangement. Both Option 1 and Option 2 require payment of the UPE at the end of the 7-or-10 arrangement (as relevant).

Since 2017, the ATO has, on an annual basis in Practical Compliance Guideline PCG 2017/13, had an administrative practice of allowing maturing Option 1 and / or Option 2 arrangements where the trust has not repaid the UPE to be placed on complying 7-year terms prior to the corporate beneficiary’s lodgment day. PCG 2017/13 does not apply to Option 3 arrangements under PSLA 2010/4.

Two questions following the release of TD 2022/D1 were:

would the ATO extend the administrative arrangement in PCG 2017/13 to Option 1 and / or Option 2 arrangements maturing in the income year ending 30 June 2022; and

would the ATO extend the administrative arrangement in PCG 2017/13 to Option 1 and / or Option 2 arrangements maturing on or after 1 July 2022 (when the ATO will have withdrawn PSLA 2010/4).

On 7 June 2022, by updating PCG 2017/13 the ATO answered ‘yes’ to both questions and included the following tables for Option 1 and / or Option 2 arrangements that mature after 30 June 2022.

The ATO extending the administrative approach in PCG 2017/13 will be a welcome relief for taxpayers with Option 1 and / or Option 2 arrangements. However, PCG 2017/13 continues to include a warning to taxpayers about the administrative approach:

Where the facts and circumstances indicate that there has never been an intention to repay the principal of the loan at the end of either the 7-year interest-only loan or the 10-year interest-only loan, the sub-trust arrangement was not entered into in accordance with PS LA 2010/4 and this may lead the Commissioner to consider that the purported arrangement was a sham, and/or that there was fraud or evasion. In these circumstances, the Commissioner may go back beyond the standard period of review and deem a dividend in the income year in which the provision of financial accommodation originally arose.

Sladen Legal’s tax team regularly advises on Division 7A and UPEs. If you have any questions about what the ATO views may mean for you and your arrangements, please contact:

Neil Brydges

Principal Lawyer | Accredited Specialist in Tax Law

M +61 407 821 157 | T +61 3 9611 0176

E: nbrydges@sladen.com.au

Daniel Smedley

Principal | Accredited Specialist in Tax Law

M +61 411 319 327 | T +61 3 9611 0105

E: dsmedley@sladen.com.au

Rob Warnock

Principal Lawyer

T +61 3 9611 0155 | M +61 419 892 115

E: rwarnock@sladen.com.au

Edward Hennebry

Senior Associate

T +61 3 9611 0113 | M +61 405 847 261

E: ehennebry@sladen.com.au

Laura Spencer

Senior Associate

M 0436 436 718 | T +61 3 9611 0110

E: lspencer@sladen.com.au